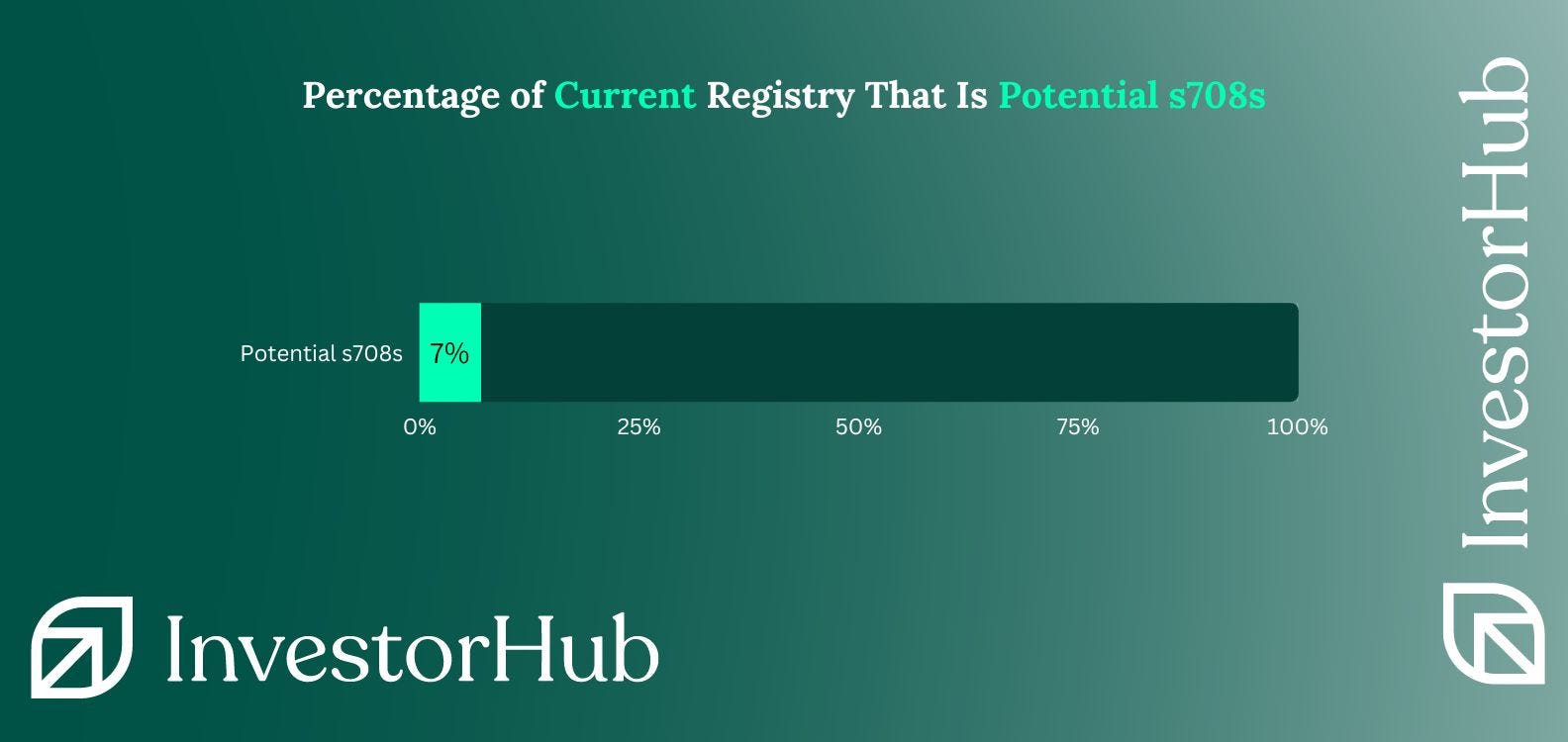

7% of your shareholder base is a high net worth investor: do you know who they are?

Sophisticated investors (s708’s) are important for issuers when considering capital raising structures and outcomes. Companies will typically structure their raises as either a placement, share purchase plan, or entitlement offer and s708s provide capital value across them all.

InvestorHub undertook a current registry analysis of dozens of issuers to identify potential s708 or high net worth (HNW) investors. What we found was that on average, 7% of current issuer registries consist of HNW investors and are potential s708s for companies to identify when considering their capital raising strategies.

Prior data we pulled also estimated the average value of an s708 investor at $54,000 when contributing to a capital raise, which now applies a dollar value to this shareholder demographic. It’s also worth keeping in mind that these potential s708s are also existing shareholders, and we know that this demographic tends to sell out slightly less post-placement as well.

With that data in mind, how would you modify your capital raising strategy with so many potential s708s on your register? Would you include a pre-raise step of identifying and reaching out to these demographics to validate as many s708’s as possible prior to your capital raise?

Want to access your potential and verified s708s? InvestorHub can help with a complementary service to help you identify and connect with the hidden high net worth investors on your register. Learn more here.