Good shareholder engagement isn't difficult: it just requires effort.

The common trap of perceiving something as "too difficult", when in reality it just takes effort.

Australian YouTube creator "I Did A Thing" did just that - he used a metal spoon to carve a wooden spoon out of a piece of timber.

Then I, and eleven million others, watched the 9-minute video that earned him somewhere around $40k AUD. Amazing…

This guy looks to have made >$1m over the last 4 years, creating and producing 81 videos. While none of them seems unreasonably difficult to make, they require effort.

And this really highlighted to me the difference between effort and difficulty.

Too often, we all use the words "difficult" or "hard" when what we really mean is "that's a lot of work" or "I'm too busy".

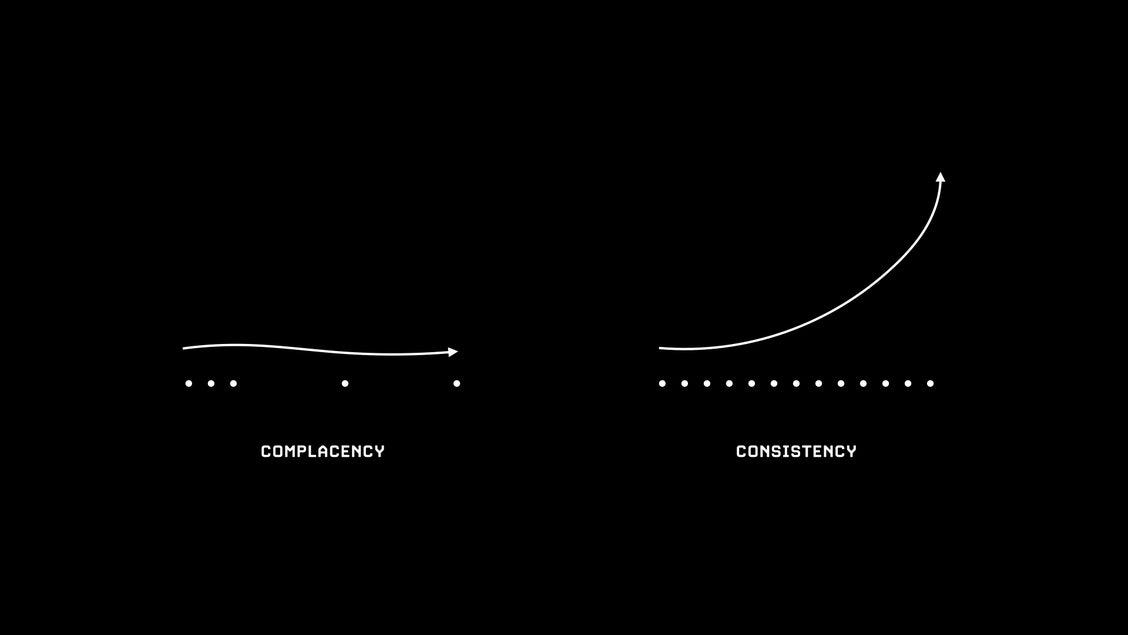

And there is a HUGE difference between effort and difficulty.

Difficulty is the inherent challenge of something. It can be high-risk, high-effort and without the guarantee of output, let alone a reward.

Effort is the amount of resources or energy you put into that challenge. Although it requires a mix of time, energy and capital, effort typically is low risk.

And anyone can apply effort, whether it's towards a difficult or easy task or a challenge.

Here are three things we misclassified as difficult but are straightforward and require some effort. I'll highlight a couple of tips on how to achieve these underneath.

#1 Talking With Investors Outside Your Top 20

Investors outside your top 20 may hold less than half your stock but account for more than half of your trading activity.

Trading activity dictates price, and, therefore, the net worth of your top 20 and yourself.

Talking with these investors (especially those prone to trading) is not difficult. You have a list of their names, emails and phone numbers.

It's a bit of effort, though - no doubt.

#2 Adding A Short Video To Your Announcements

If a picture tells a thousand words, a video saves a thousand words.

You can demonstrate more conviction, engagement, and enthusiasm in a short 3-minute video than in a 30-slide deck.

Announcements that include a video get 5x the engagement, and though it's a little more effort now, you'll save yourself hundreds of calls, emails and texts down the line.

#3 Segmenting Investors And Writing Different Narratives

As we've previously discussed, different investors have different goals and timelines.

A fund with a 2-year horizon is different to a desk broker responsible for 200 HNWs. The fund is looking to outperform the market, whilst the desk broker wants to make money without losing any.

Different outcomes require a different message. Tailored narratives are crucial when communicating with investor segments to build ongoing relationships with your varied stakeholders.

Tips On Achieving These?

As you can see, none of the above is particularly difficult or really has much risk. It's extra work to what you're doing now, which requires effort.

My big tip is to hire an internal resource.

External IR is important, but the model doesn't align with this much work and effort. They should focus on specific tasks, e.g. setting up roadshows or doing PR work.

An internal IR resource can take a lot off the CEO/CFO's plate and adds much more value to the company, and its shareholders.

I constantly talk to CEOs who take on all the IR work themselves, especially in listed start-ups and scaleups (defined as companies sub $30m and $100m market cap, respectively.

As a reminder, we think you should be spending 1.5% of your market cap (up to $1.5m), every year to maintain and grow it.

In this context, putting on an FTE whose sole job and obsession is not just the market, but outcompeting other listed companies for every investor dollar, makes a lot of sense. They can do this by talking to more investors, creating videos and segmenting the market.

Nothing difficult, just effort.