Effort, UX, and the retail revolution.

In 1999, the reported average holding period of shares was 14 months. Fast forward to June 2020, a Reuters article reported it had dropped by 60% to 5.5 months. Looking back even further, the average holding period across the 1950 and 1960s was eight years.

Look out, Millennials, the Silent Generation are the real diamond hands.

There are multiple factors behind this decrease, but for today’s article, I want to talk about one: the rise of low-effort investing. Low-effort investing is a relatively recent addition to equity capital markets, and it has caught many companies off-guard. The good news is that, like Andre 3000, I’ve got your back like chiroprac’, and have some practical tips to help you capitalise on the new era of low-effort investing. But first, let’s set some context…

The meteoric rise of low-effort investing

Up until the 2010s, retail investors still had a relatively high-friction trading experience. Even trading on my CommSec account had a fair amount of limitations, and I certainly couldn’t easily trade from my phone. That all changed when Robinhood and co created a trading solution that reduced the effort it takes to trade down to a single touch of a button.

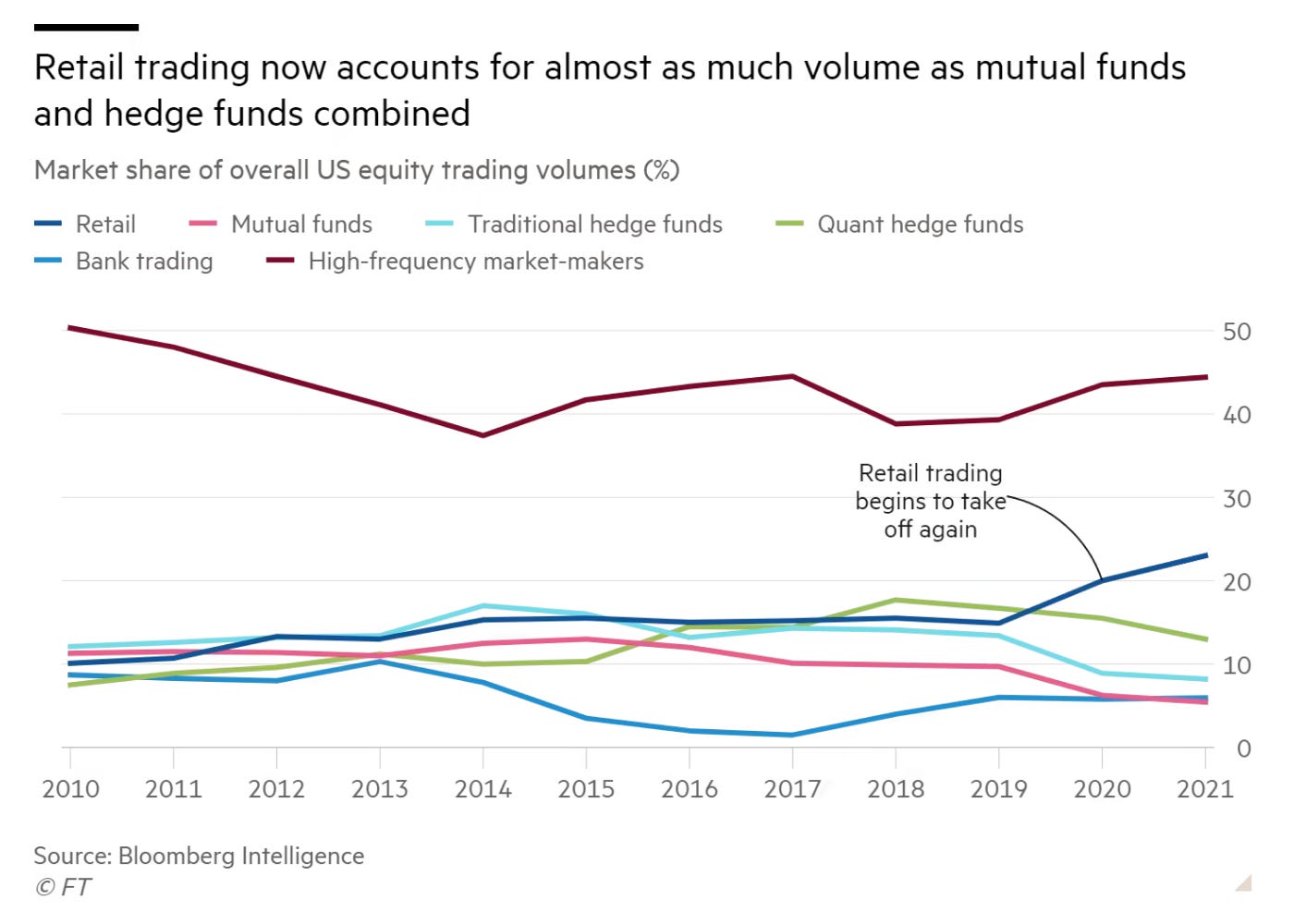

This changed everything. Suddenly, retail traders became the 2nd-strongest source of trading volume in the US and became a powerful influence on small cap stocks.

Looking at macro-trends, low effort investing was inevitable

The change in the retail investor experience mirrors the change that consumers have experienced across most other industries. From food delivery and transportation to banking and news consumption, the modern consumer experience revolves around speed and convenience.

In the world of Customer Experience (CX), “value” is often measured in terms of “effort”. The less effort a customer has to spend, the greater their perceived value of a product or service. Low-effort experiences are a significant driving force behind the success of companies like Netflix and Amazon.

In 2019, the “effort effect” on the investor experience was clear as day, with two ultra-low effort experiences at the fore: (1) trading and (2) accessing information.

Low effort trading occurs if I want to buy or sell a stock. I can do simply login to my investment app and buy or sell equities or options in under 30 seconds.

Low effort access to information occurs when I am researching a security that I am interested in. It doesn’t even matter if I don’t know where to start, as I can perform a simple google search that will lead me to a relevant Reddit forum, Simply Wall St page, Motley Fool article, or HotCopper forum. All of this can occur in under 5 minutes.

Issuers have not adapted to this decrease in effort, and that’s a problem

Yes, your investor centre has an email address, but consider the relative effort a retail investor has expend to communicate with an issuer. Compared to how easy it is to trade or find information from third parties, the effort required to communicate with a company is too high for many investors.

The ASX’s 2020 Australian Investor Study quantified this statement when it showed that next-generation investors are 5x more likely than retiree investors to use social media and third-party reports to make investment decisions.

Retail investors are not engaging with their investments because its too hard

At a time when retail investor importance is increasing, issuer influence over the retail investor experience is dwindling.

A small minority of companies understand this and have taken steps to resolve this problem. Extreme examples include Jeff Bezos buying the Washington Post and Elon’s Twitter takeover saga. For the majority of companies that cannot buy a masthead or social media giant, the next best thing is to create a retail investor IR strategy that is catered to this unique type of investor.

Lucky for you, I’ve compiled a few practical tips drawn from the learnings of the 2,000+ capital raise cycles that we’ve been involved in to give you ways to meet the expectations of retail investors.

- Publish investor questions

Marketers have published FAQs for decades, so why can’t IR teams publish investor questions? If one person has asked it, you can bet that others are thinking it. A simple investor FAQs page can work wonders. - Go multi-format

1/3rd of investors prefer to receive information via video over text. Using tools like Loom to create video summaries of your announcements and press releases can significantly increase investor engagement. - Use multiple channels

Don’t limit your reach. Use email, social media, PR, and the ASX to distribute your communications and increase the chance of reaching current and prospective investors. - Be interactive

The rise of chat systems like Messenger and Intercom proves that interactive channels are valuable ways of communicating with consumers. In this regard retail investors are no different, which is why the Interactive Announcements feature on InvestorHub is a useful tool for investor relations. - Be frequent

Investors have thousands of investment opportunities available to them at the touch of a button. High frequency communications ensures your investors cannot be tempted away from their position in your company.