Ever release great news but the price drops? Here’s the fix.

Without momentum, even great announcements can flop. Learn the 4Ms that drive sustained share price growth and how to turn news into impact.

Hi there,

Most people believe "we just need to deliver on the business and the market will reward us," whilst those in the know understand there is more to it.

A while back, I wrote about the "3M's" that drive share price performance:

1. Micro - what's happening inside your business.

2. Macro - what's happening in the world around you.

3. Marketing - how you connect and communicate with the market.

And I believe these three still hold true today.

But as we progress through 2025, we need to add a fourth M.

Momentum.

It's the market's compounding effect where your news, story, and execution create an energy that pulls investors in, even between major announcements. It turns a good quarter into two, and two into a run that lifts your share price for months.

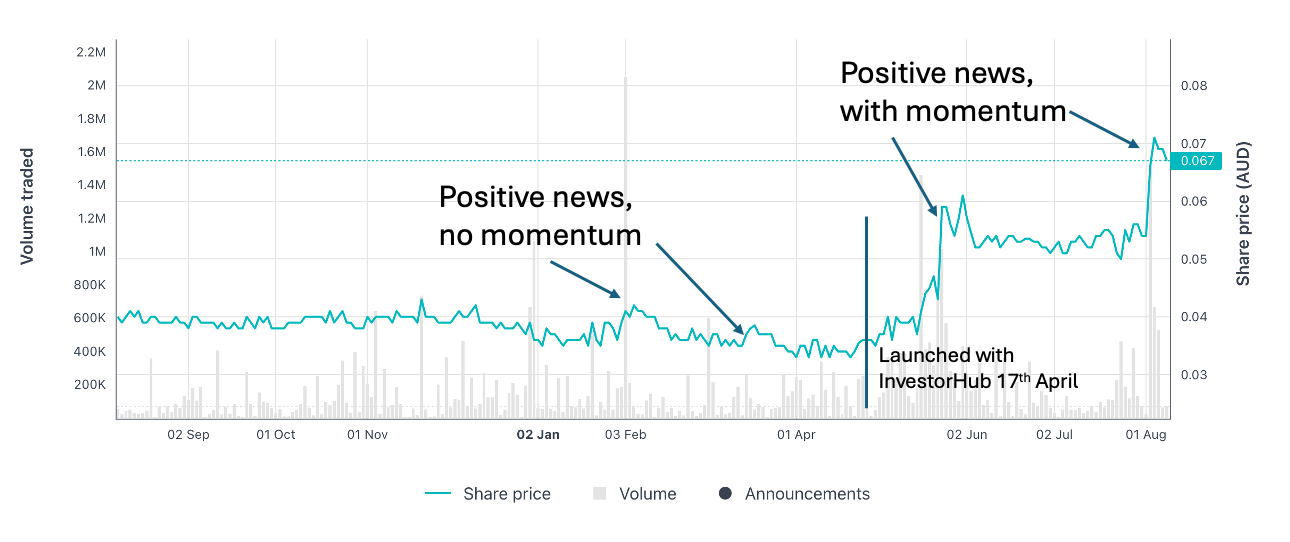

Good news can create very different outcomes depending on the momentum.

And we have a great example from one of our clients:

Positive news, even great news, can result in a liquidity event if it's not supported by momentum. Have you ever released a great announcement, only to see the share price drop, and you're left wondering why?

It's because there's no reason or energy that pulls investors in.

There's no momentum to keep them invested, and that hurts your share price.

But you can't sit back because momentum doesn't appear on accident. It's built over time, strategically and proactively, by public companies.

Here's how you can start building momentum as part of a plan:

- Feed the story.

Share smaller but meaningful progress points between major updates. These don't have to be ASX releases, so just get a good cadence running with newsflow and don't let the trail go cold. - Build investor relationships.

You don't need to know everyone, there's no time for that, but work out how they can know you and follow you. Answer questions, comment on sector news, and show you're part of the conversation, not just at quarterlies. - Create reasons to engage.

Website, site tours, investor days - all can be catalysts that make "now" the right time to buy. Big investors are 1:1, medium investors are 1:20, and retail are 1:2000 (video is an effective way to scale to all these events).

So micro, macro, and marketing - it all feeds into momentum.

And if you have to ask if you have momentum, you don't. Not yet anyway. Because you'll know when you do, it's a great feeling. Let's aim for momentum. It's the difference between your good news popping... or flopping.

As always, hit reply or book a time, if you want to talk further.

Have a good weekend,

Ben.