How different shareholder types behave after a capital raise.

InvestorHub has analysed the behaviour of hundreds of thousands of investors to understand the post-placement activity for dozens of issuers and how different investor types (in this case, new versus existing) behaved post-placement. The difference that we found between the cohorts is not what you may expect given the general perception of existing versus new shareholders' behaviour.

We posted a poll last week to see what you thought would be expected in this situation. Specifically, whether it’s existing or new shareholders that are more likely to sell during the post-placement period of a capital raise. 75% of poll participants agreed that it was new shareholders that are more likely to sell down positions and this is reasonable considering many would argue that holding multiple tranches of a stock is indicative of shareholder loyalty.

75% of poll respondents are correct, however, our data suggest that the difference between these shareholder types is much smaller than most would expect.

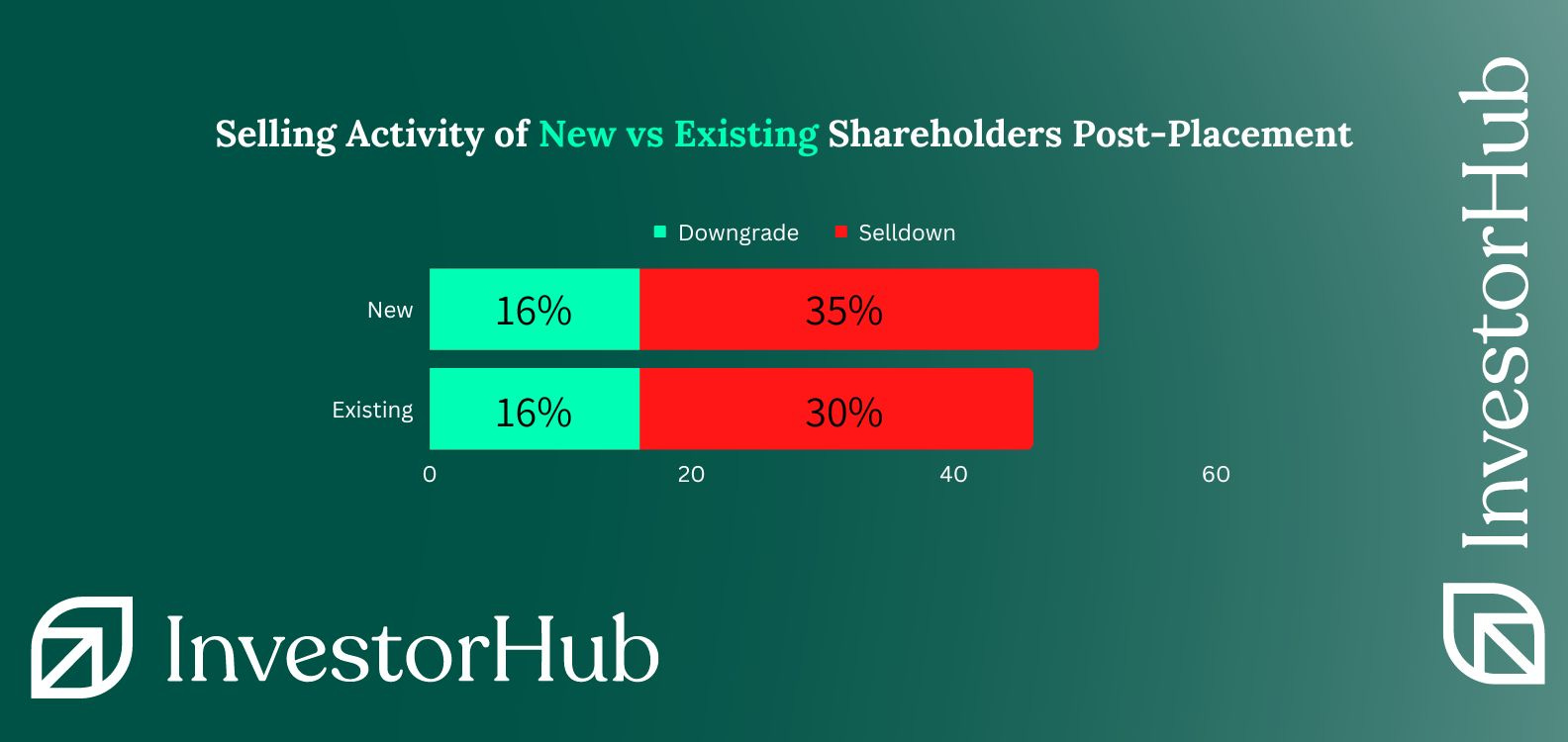

- Both types are equally likely to downgrade (reduce positions).

- New shareholders are slightly more likely to sell out completely (35% vs 30%)

When it boils down to a single statistic; new shareholders will either downgrade or sell out 51% of the time versus 46% for existing shareholders

Was this the difference you expected, because it certainly seems minor to me; especially when you consider how differently new and existing shareholders are perceived when discussing investor behaviour.

It’s fairly easy to think that post-placement activity can be attributed to a single investor types but as seen above, it doesn’t appear to be quite so simple. If anything, this supports that post-placement strategies around retention and engagement, apply to all investor types.

Want to dig into these stats yourself? InvestorHub offers a post-placement analysis feature for clients to uncover insights into your shareholder behaviour.