How first week selling dictates post-placement activity.

Investor selling activity presents challenges for issuers looking to understand what drives these decisions and how they can convert shorter-term traders into longer-term shareholders.

As part of InvestorHub's investor behaviour analysis for issuer placements (specifically; post-placement selling activity), we were able to identify a key statistic that issuers can reasonably leverage in their shareholder engagement and retention strategy.

We’ve already established three statistics in prior reviews;

- 44% of shares are sold within the first 3 months post-placement (source)

- New shareholders are slightly more likely to sell than existing shareholders (source)

- Shareholders are more likely to sell down completely rather than downgrade (source)

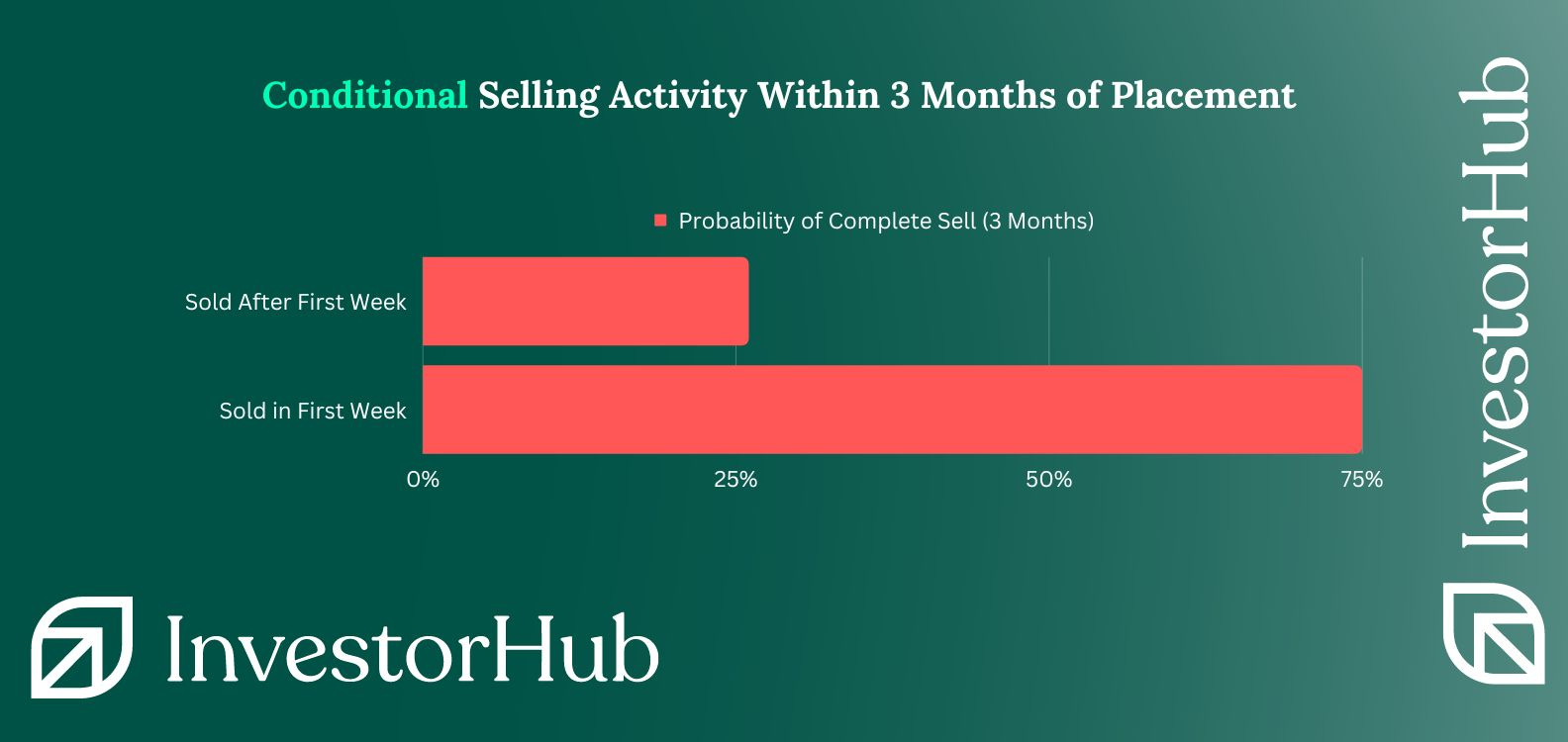

What we’ve found most recently is; that investors that sell within the first week of a placement are 3x more likely to sell out completely by the end of the first 3 months (75% vs 26%). That’s 3x as in '300% more likely to contribute to the selling down completely' category of shareholders, all based on the first sell timing.

Think about it like this. If you can find the investors who sold within the first week, you’ve just identified a high-risk, high-conviction shareholder demographic who are almost guaranteed to account for future selling pressure within 3 months.

The best part? You’re ahead of their decision curve. Ever considered what it would be like to play poker while seeing everyone else’s cards? Knowing how investors may act presents you with an opportunity to positively influence their behaviour before it occurs, and that’s something we offer with InvestorHub.