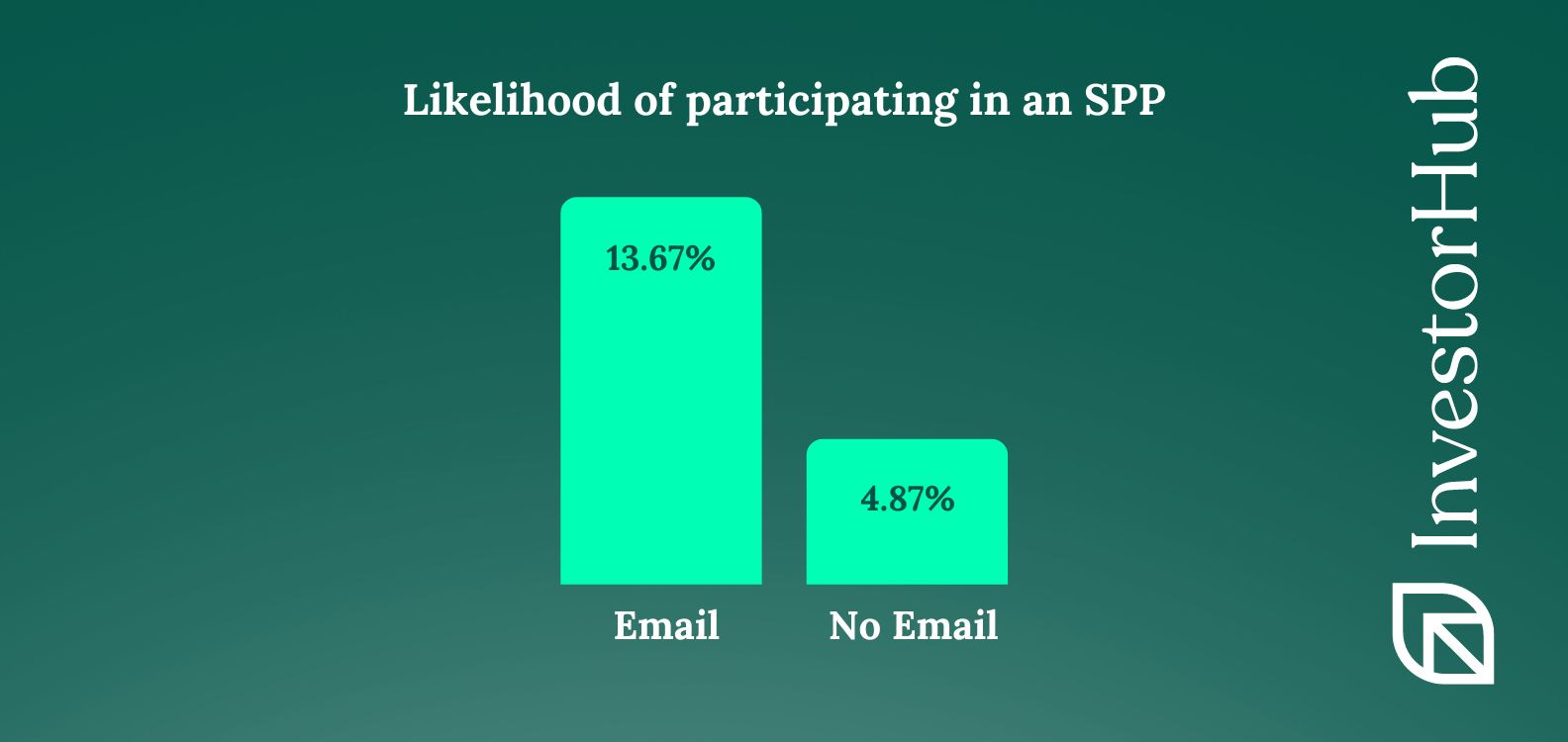

Investors with an email address are 2.8x more likely to participate in a raise.

When a company chooses to offer a Share Purchase Plan (SPP) to its shareholders, it is usually an anxiety-filled experience for its executives. With the average company only having 30% of its investors' email addresses, the best method for shareholder communication for most issuers remains the postal service.

The issue with sending mail, of course, is that it isn't instant and isn't traceable. In one memorable test that InvestorHub ran in 2021, mail took a total of three weeks to arrive in some investors' letterboxes. 2021 was admittedly a year disrupted by Covid-19, but the fact remains that during an SPP, the last thing that an issuer needs is their mail service to be so slow and unpredictable.

To resolve this issue, companies have been trying innovative ways to collect investor email addresses. The question has always remained, though, "how much more effective is it to have an investor's email address?"

InvestorHub recently analysed the registry data of dozens of issuers to try to understand if there is a correlation between SPP participation and email data. It turns out that there is!

The report found that the participation rate for those with an email address on file is 13.67%. For those without an email address on file, it’s 4.87%. That represents a 2.8x increase in likelihood of SPP participation from investors with email addresses vs. those without.

So if you're considering how to maximise your next capital raise outcomes, you might want to consider how you can increase the number of investor email addresses that you have (something that InvestorHub can help with).