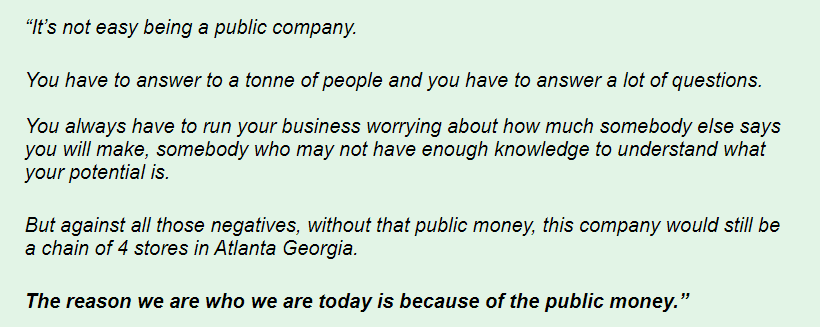

It’s not easy being a public company.

Regular readers know I love a good podcast (always open to recommendations).

I consume more than 10 hours of them a week, and this week I came across an absolute cracker.

It was covering a book (which I've since purchased), and there was one paragraph I had to share.

This quote is from one of the founders of The Home Depot, a $325b USD company founded in 1978.

And like so many of us, it nearly died before it started.

Raising money. Validating the business.

A hundred decisions in the first few years that, if made incorrectly, could have torpedoed a now vast fortune.

The Home Depot was listed on the NASDAQ only 3 years later as a fledgling business, raising $4m USD in an IPO.

The company took some time to warm up as it spent its first 4 years hovering between its IPO price of $0.20 and $0.40.

It then moved to $1 before legging up over the decades to now more than $300 a share.

I thought this was a good reminder of the oft-forgotten clear benefit of being listed.

This comes from the founder and ex-CEO of a half-a-trillion dollar (AUD) company admitting that without the capacity to raise from the public, they would not have gotten past the first few stores.

Imagine that; billions of dollars of value gone 💨

Being listed is hard, without a doubt. There are definitely costs to it, but the benefits far outweigh them if you're a growth company that needs capital.

It's easy to move on from that and forget the millions you've raised.

Take a minute and add them up. The stark reality is that most sub-$50m companies have raised anywhere from 50% to 150% of their current market cap.

IPO, RTO, SPP, ANREO and Placements.

All powerful tools for a growth company spending more than they're making. We just need to be ready to use them.

For now, I encourage you to remind yourself, during these challenging market times, of the long-term benefit of being listed.

Add up how much you've raised, take comfort and pride from those events, and know that the market is there to help you grow and is a powerful tool if used to its fullest extent.