Only 1/3rd of CEOs are responsible for Investor Relations?

Last week’s question to the community was “who owns investor relations at your company?”

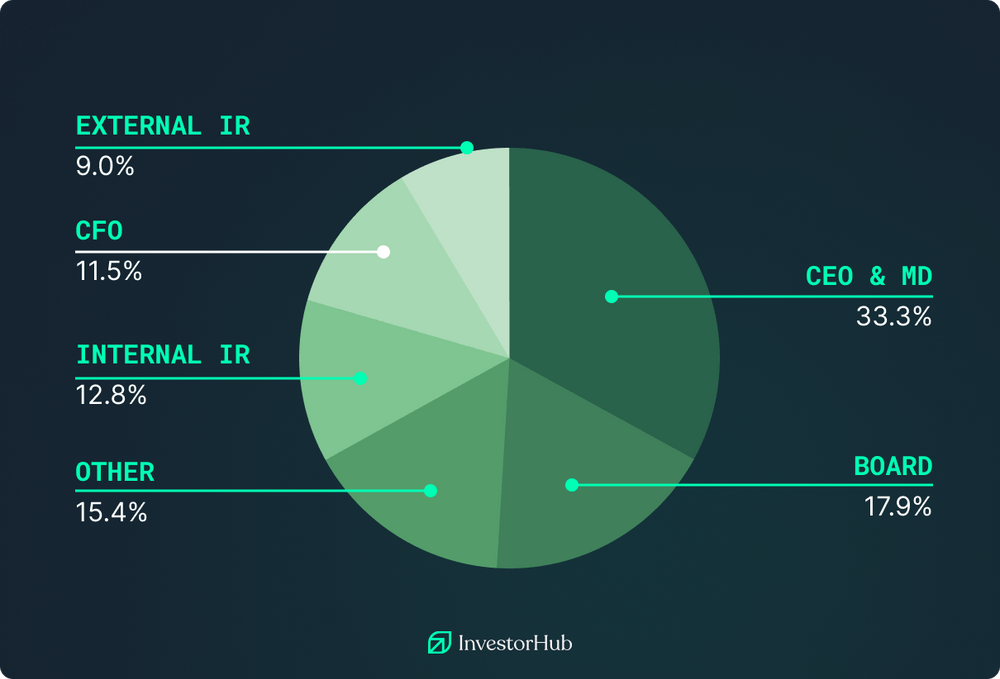

Here is the breakdown of the 70+ responses that I received:

Before I asked the question, my assumption was that “CEO/MD” would have taken up at least 70% of the votes, with boards and CFOs taking the balance.

My assumption was also that IR, whether internal or external, would be considered as a “doer” rather than an owner - their combined representation of just over 20% of responses was therefore a surprise. In addition, the catch-all answer of “other” surprised me with a whopping 15% of votes. Those of you who voted “other”, I’d love to hear more about what those roles are.

Two takeaways, one theme.

Before I continue, I would love to know your own takeaways on these responses. How did you vote, and why did you vote that way?

(1) The first takeaway for me was the concept of ownership.

In theory, all ownership belongs at the board and is then delegated out. The board is responsible for strategy, acting on behalf of shareholder interests, and appointing key management to run the business.

In the majority of listed companies, all executive aspects of the company are delegated directly to the CEO/MD and sometimes directly to the CFO.

Hence my assumption that, except for instances where there is an executive director or chair running the IR function, then IR ownership would sit with either the CEO/MD or CFO.

Enter my surprise when CEO/MD’s only had 1/3rd of the responses, and CFO’s another 11.5%. That is less than half of companies delegating ownership of IR to, in my mind, the most obvious candidates.

The concern that this raised with me is not that IR isn’t being done, per se, but that the people that have been empowered by the board are not acting like they own the IR function. Yes, they can and should delegate work, but that doesn’t mean they don’t own it.

Ultimately, the relationship between a company and its investors has to be owned by either the chair, the CEO/MD, or the CFO. These are the people who are responsible for delivering shareholder value, and therefore must be accountable for the reputation of the company, the story that is told to the market, and the journey that investors buy into. Delegation of those responsibilities is, in my opinion, a bad idea - someone with less skin in the game owning this critical function is a huge risk.

Think about it another way: if a CEO has a Chief Revenue Officer, does that mean the CEO no longer owns revenue? Of course not. They still own it, but they empower someone else to deliver on it.

In the same way, anyone who is empowered to do the work – internal IR, other C-level roles and even external IR – will not have ultimate ownership of the function.

Perhaps I am reading too much into this, but also, I see the impact of this delegation of ownership play out in the market every week. Too many CEOs and CFO’ only focus on a very small subsection of their investor base - namely the top 20 and institutions - and are surprised when their stock price plummets, their capital raise doesn’t get away, or they face a shareholder revolt at an AGM. When you delegate ownership of your investor relations to someone else, then you open up the risk of being blindsided by an ever-increasing representation of individual shareholders.

Now I am not saying that CEOs and MDs need to pick up the phone and call Sam and Mary from West Sydney who own $2,500 of stock. But they do need to make sure these shareholders are informed and engaged – somehow.

Which leads me to my second takeaway: how a lack of ownership drives a lack of accountability.

(2) One company, two answers.

In the 2 years since we launched InvestorHub, there have been over 2,500 questions asked by investors of our clients. The majority of those questions are questions that aren’t easily answered in announcements or presentations.

A typical question is mostly related to strategy, and reads like this one that a client received on their hub just a few days ago, “Are you expecting to fast-track any of these assays or wait for them all to be completed before sending to the lab?”

Translated, the question is essentially asking, “how fast are you willing to move to hit your growth targets?”

Now consider the responses that you might get from a non-CEO vs. CEO.

For the non-CEO, the response is likely to “toe the party line” and answer the question at a surface level - something like, “yes we follow standard procedure and will wait until completion before moving onto the next phase”.

For the CEO, they have more control over their response because they have more control over the business. In our users’ case, they were able to respond with a message that effectively said, “if things look promising then we will move faster.”

The difference between the two responses isn’t huge, but the message that they send is worlds apart, and herein lies the issue with delegated ownership. Scale that one-on-one interaction across multiple times per week, and over the course of 12 months the the story told be the non-CEO is very different to the story told by the CEO.

That isn’t great.

When more than one person “owns” something, then the lack of clear leadership results in worse results. Commonly referred to as “having too many cooks in the kitchen”, there are multiple studies into the detrimental effects of shared ownership on a specific topic. In short, they find that clear ownership combined with a clear hierarchy of responsibilities is significantly more effective than shared ownership.

Think about your own experiences with shared ownership: assumptions are made as to who owns what, but when something new comes up and slips through the cracks, the trouble begins. Over time, those cracks widen, until we look back and ask “how did we get here?”

When applied to IR, the consequences can be severe: confused shareholders, an inconsistent (or worse) story, and unchecked speculation to name just a few.

So does this mean that you cannot delegate IR? No. Delegation and ownership are two very different things, which I will explore below.

IR operations can be delegated, IR ownership cannot.

This lack of ownership isn’t really something you would come across in most other facets of the business. But for many public companies, especially small cap companies, it is frequently overlooked.

Why is this so?

Well for IR, as for many types of communications functions, I believe there are two common factors that contribute to this.

- A lack of skill.

Who here has studied IR or communications in any formal capacity? I know I certainly haven’t, yet here I am writing a weekly newsletter. Communication is often a demand that is thrust upon leaders, and for many, it is a task that we reluctantly take up. With that reluctance comes a stronger willingness to delegate to others and, here’s the crux of it, even the act of delegation is done half heartedly. As a result, so much communication gets lost in translation.

How do you overcome this? Either lean into your communication responsibilities or learn how to delegate communications effectively. - A lack of measurable outcomes.

The other reason that IR ownership is often ambiguous is how difficult it is to measure. Unlike revenue, drilling results, clinical trials, or commercial agreements, IR doesn’t have a clear “bottom line” that allows leaders to gauge their performance and improvement. As a result, when combined with a typical lack of enthusiasm for the task, there is little incentive or reward for a leader to take ownership of the function.

How do you overcome this? For me, it's about taking a long-term perspective on things. I often instruct my team to look back on the work that they did 12 months ago and compare it to now, because inevitably, people are shocked at their rate of improvement. Also, I have a little button at the end of email which readers can click to signal their enjoyment of my article - the dopamine hit I get when its pushed is still the same as it ever was.

So for me, IR is 100% something that you can delegate at the task level - we have many effective users at InvestorHub who delegate tasks to via the platform all the time (I know this, because I can see the data). But delegation and ownership are two different things, and if you are delegating ownership for your company, then you are playing a risky game.