The invisible risk in capital markets strategy.

Eighteen months ago, Meta banned Australian news publications. Why? Because the government backed a call for social media platforms to pay news publications for content distributed through their platforms.

The ban made international news. Former treasurer Josh Frydenberg went on the record to say that the situation demonstrated the "immense market power of these digital social giants". In one fell swoop, the concept of "platform risk" was felt by most Australians.

Whilst I recognise that your own company’s revenue model likely has minimal platform risk, I guarantee that your capital markets strategy does. Don’t believe me? Spare me six minutes of your morning and I’ll tell you a story about where platform risk exists, why it's an issue, and what you can do about it.

The invisible risk in capital markets strategy

Firstly, let’s define “platform risk”. My preferred definition reads as-follows:

”Platform risk is the debt associated with adopting a platform. Platform risk becomes an anti-pattern (i.e. cause of company failure) when three conditions are met:

- The platform dependency becomes critical to company operations.

- The company is unaware of the extent of the risk it has assumed.

- There is increased likelihood of adverse platform change.”

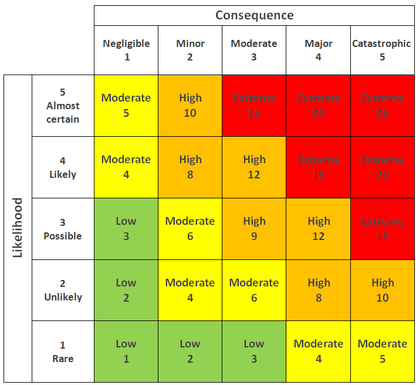

An assessment of capital markets platform risk puts it on par with a helicopter crash or my auntie June beating me at a game of mahjong: rare likelihood with catastrophic consequences. Using a risk assessment matrix, platform risk can be considered a moderate risk, and therefore something to be mitigated.

The platform risk of registries

Today's generation of business leaders can thank modern registries for the ease with which they can conduct capital markets compliance and shareholder communications. Your 1920s counterpart would likely look upon the modern registry experience with a mixture of disbelief, amazement, and jealousy. Coincidentally, it’s the same look I have when my eldest daughter shows me what she coded at school today.

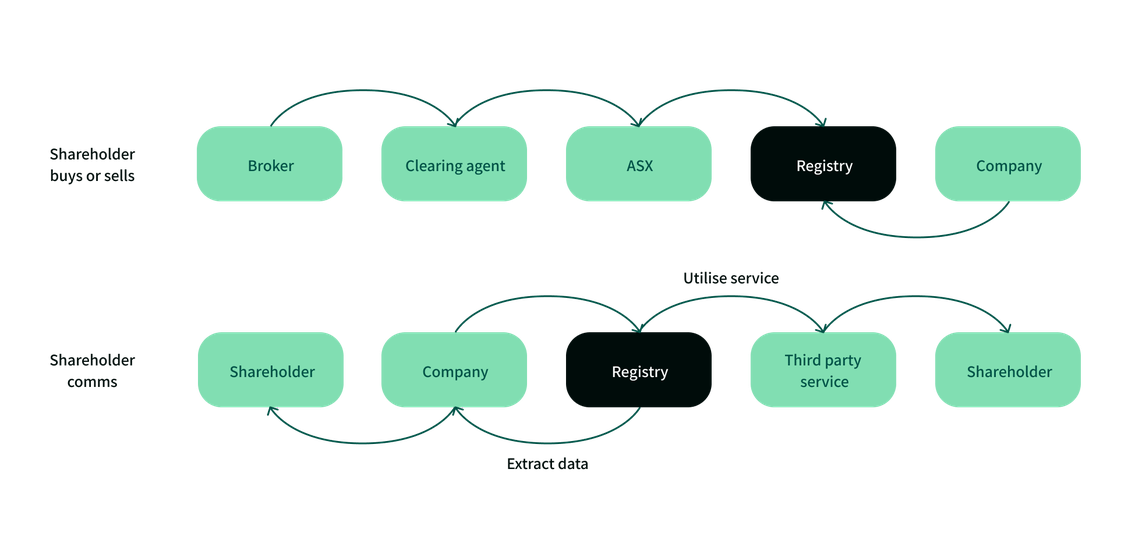

The point is that whilst registries bring amazing efficiencies and capabilities to modern issuers, the price we pay for this is platform risk. Consider the diagram above and the role that your registry plays:

- It stores shareholder data;

- It is a channel for direct communications; and

- It facilitates third-party capital markets services.

Those three functions are all high-value, and I bet that if your registry disappeared tomorrow, the impact would be devastating. Knowing who your shareholders are, being able to communicate with them, and facilitating transactions would suddenly become a complex ordeal with no obvious solution.

Despite the fact that your shareholder data is owned by you, the convenience and value created by your registry creates significant platform risk.

The platform risk of brokers & investment banks

These entities are not technically platforms, but they nonetheless come with platform risk. This type of platform risk is very specific, though, and only exists for a small, but crucial, period of time.

After participating in 2,000+ capital raises over the past four years, I know that the inelastic nature of raising capital favours the broker. What do I mean by this? If you remember my article from a few weeks ago, a capital raise is only successful when you achieve a minimum of 100% success. Companies have little room to be flexible once they have chosen a broker to lead their placement, lest they compromise their chance of success.

This shifts the balance of power to brokers. Once you engage your broker, you're sidling into the passenger seat whilst they take the wheel for a few weeks.

The platform risk with brokers, therefore, is temporal. For a few weeks every 2-3 years, many companies willingly take on platform risk in exchange for capital. Add in mandate and/or a large swathe of broker options, and you may find that risk sticks around all year long. Like registries, the service is crucial, but it also comes with platform risk.

The platform risk of Investor Relations

Platform risk within IR functions is typically low, even when you outsource it, but it can exist in the form of "borrowed trust". Borrowed trust occurs when you engage a professional to leverage their relationships with high-net-worth individuals, institutional investors, or family offices.

When it comes to borrowed trust, until you form a personal relationship with investors, your IR function is in the driver's seat.

So how risky is platform risk?

The identification of platform risk exposes the level of control (or lack thereof) that issuers have over their capital markets performance. As unlikely as the risks I've described may seem, for most issuers there is no strategy to combat platform risk. As I highlighted earlier, as unlikely as platform risk seems it should be considered a “moderate risk”.

How willing are you to not have a mitigation strategy in-place for something that is classified as moderate risk? Whilst legal recourse is typically available, the damage done to your share price in the event of a platform risk eventuation is irreversible. Isn’t mitigation, rather than litigation, more appropriate for something that is deemed to be a medium risk?

Mitigating platform risk

Having built an entire platform to help issuers engage directly with shareholders, I have some practical tips that you can employ to help mitigate platform risk.

- Own the investor: Bring your investor data into a secure service or platform that you have control over. You don't even have to do anything with it, but having it stored as a backup will provide peace of mind.

- Analyse broker performance: The recent history of brokers can give you a fair expectation of things like discount and post-raise selloff pressure. This data isn't impossible to find, but it can take some digging.

- Analyse past raises: You may be surprised at the percentage of your registry that has participated in past capital raises. Add in the average participation rate and you may find that you have more available capital from existing shareholders than you realise.

- Build your own relationships: One of the simplest and most effective things an executive can do is invest in personal relationships with shareholders. When you think of Australian issuers with a reputation for strong IR, the one commonality they share is that they invest time in engaging their shareholders (a reminder that there is a current offer to email a shareholder in exchange for a bottle of wine from me).

That's it! Platform derisking isn't rocket science, but it could certainly save you from blowing up on the launching pad.