The unexpected force driving market dynamics.

Last week, we explored the “winner takes all” dynamic that’s come to define the ASX in 2024. This week, let’s dive into one of the key drivers behind that phenomenon—ETFs— the powerful tailwinds they’re creating for ASX200 companies and the implications for small and micro caps.

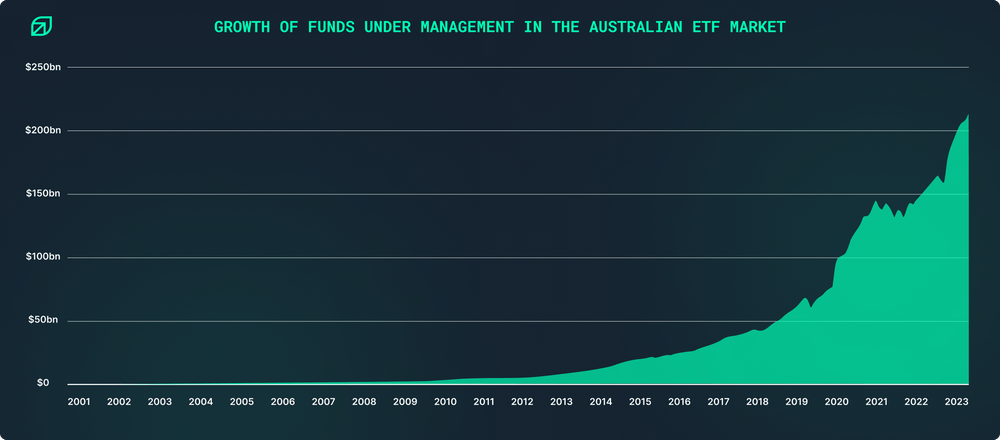

In the last financial year alone, Funds Under Management (FUM) in Australian ETFs surged by $56bn, an incredible 37.3% growth. Looking back to 2001, the growth has been nothing short of staggering, and it’s accelerating.

For micro and nano cap companies, this is bad.

ETFs are often seen as a smart, low-risk investment option. They offer a simple way for investors to capture the market’s upside while limiting downside risk through passive, diversified strategies. If someone in your family with little investment knowledge asked how to invest $100k, chances are you’d recommend an ETF.

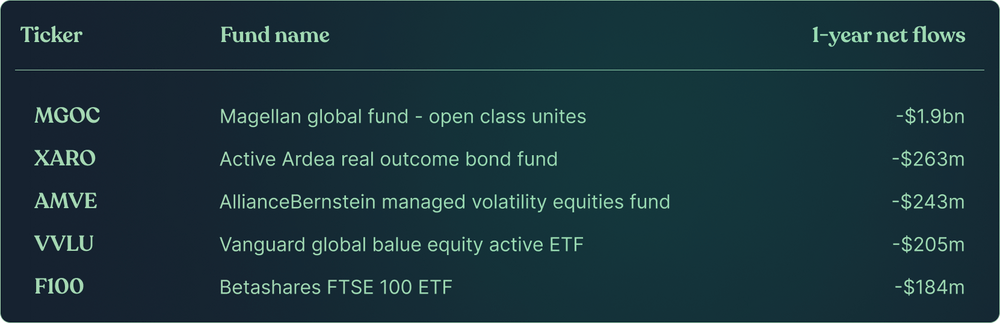

Australian investors tend to favour index-based strategies. The inflows and outflows across top ETFs highlight a clear preference for companies already in the index.

This preference is creating a significant tailwind for larger ASX companies. But how strong is that wind?

The ETF tailwind.

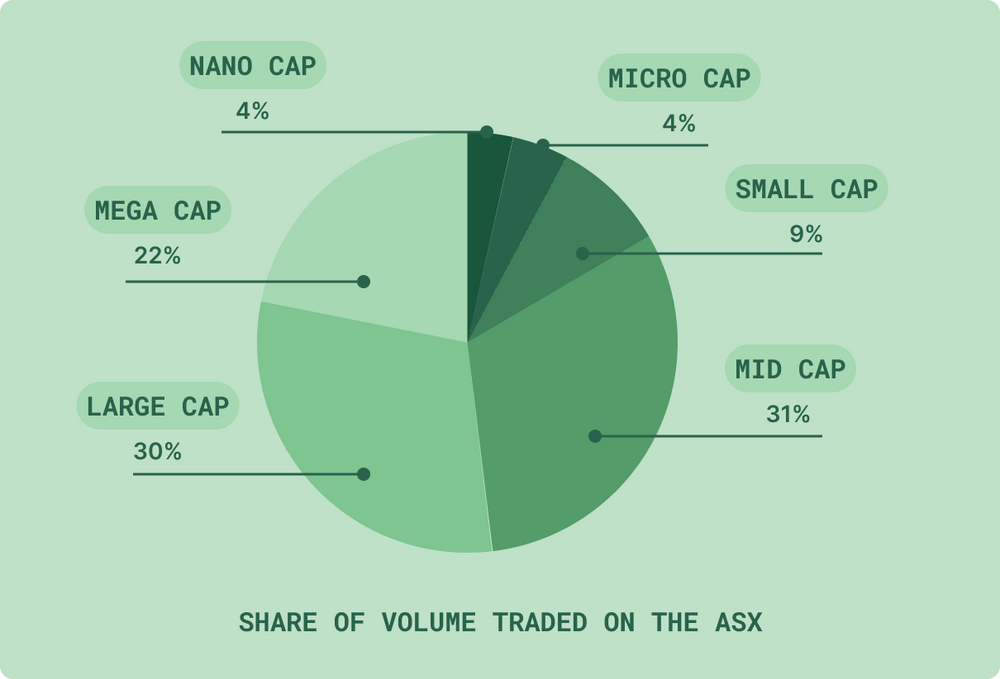

In FY24, $750bn in secondary capital was traded on the ASX, driven by both buys and sells.

The ASX200 has been on the rise, so we can estimate that just over half of that, around $400bn, was buying activity.

And most of that money goes to just the top 25% of companies.

Let’s break down the trading volume by market cap categories.

On any given day, larger companies dominate, with small caps and above accounting for a whopping 92% of total trading volume. That’s roughly $368bn in inflows every year.

A timely reminder: there is now over $350bn in funds under management in Australia, most of which is flowing into indexed companies. That’s a massive tailwind that larger companies have for no other reason than being in the index.

But as last week’s article showed, the vast majority of companies are micro and nano caps. Where does that leave them?

An unfair advantage.

The reality is, your indexed competitors benefit from an unfair advantage. Institutions love them, and “safe” retail investors do too.

On top of the 92% of capital going to these companies, there’s a “double jeopardy” effect at play. Companies in the index attract significant tailwinds simply by being there. And the forces that provide this money are growing, fast.

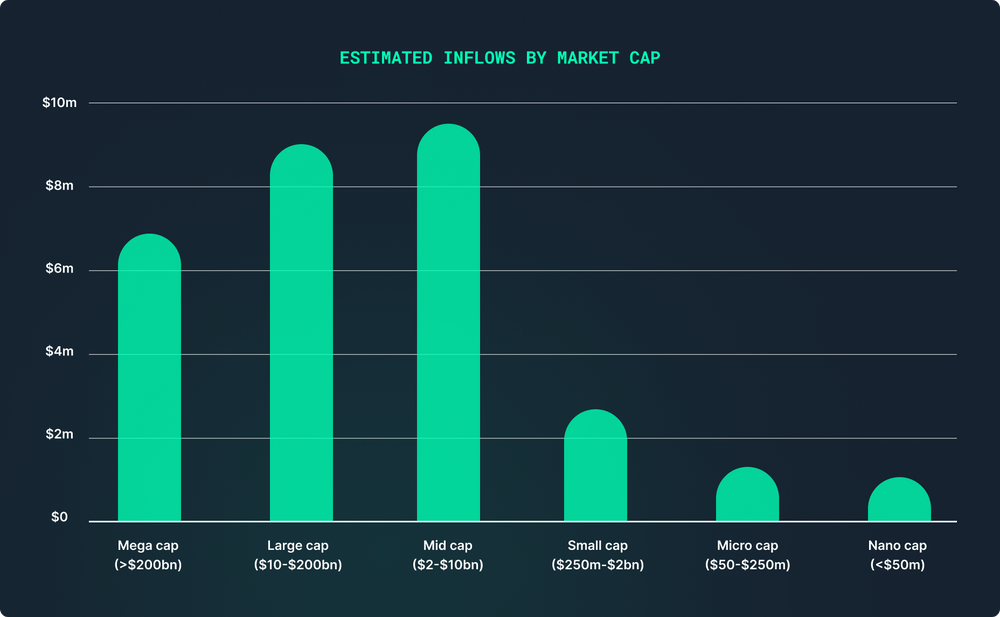

For micro and nano caps, the numbers are far less encouraging—just $21bn-32bn in inflows.

A quick look at average trading value over the past year tells us that this looks like just $2.5k-3.5k in daily buy orders for nano caps, or $26k-44k in daily buy orders for micro caps.

Worse still, these companies don’t have tailwinds to help them grow.

So what do we do with this information?

It’s easy for small-cap companies to assume that being public grants them access to the full pot of available capital. In theory, this is true. In practice, it’s a different story.

For companies looking to climb the ranks, it’s important to recognise that the pool of capital is limited, and external tailwinds are few and far between. The majority of the momentum will need to come from within—from finding the right investors and building lasting, mutually beneficial relationships with them.

Your strategic advantage.

Every strength casts a shadow. For ASX200 companies, the sheer size of their shareholder base makes it difficult to build genuine conviction among shareholders. With tens of thousands of investors, it becomes increasingly challenging for companies to build genuine engagement with their shareholders.

As a smaller company, you have the advantage here. Whether you have 400 or 4,000 shareholders, you can create meaningful connections with them. You’re already doing this with a few key investors. Now, it’s about scaling that approach—reaching a few hundred more, and then a few thousand.

Our community resource centre is packed with free resources to help you achieve this. One guide I’d highly recommend is the Investor Journey, which breaks down how to segment and communicate with shareholders at different stages of their investment journey.

Or, if you’d prefer, I’d be happy to walk you through how direct-to-investor marketing is helping public companies overcome these very challenges.

But here’s the takeaway: what if you approached every year as if there was only $3k-30k in daily capital available to you? How would you treat your shareholders? How would you raise capital? Would you try and get more shareholders onto the register? Or would you focus more on your existing shareholders?

Start by answering these questions, and you’ll be on the right track.