Two ways funds make money selling at a loss.

Instos, hedge funds, and how they can pummel your stock, leaving you royally screwed.

For a company, the first goal of a capital raise is to get the money you need to keep growing.

The second goal is to get that funding from sticky investors (for obvious reasons).

So it can be frustrating when a fund purports itself as long-term before rocketing out as soon as T+2 comes through, and your share price is an emaciated shadow of its former self.

Why do they do it? How do they make money when it looks like they sell at a loss?

Here are the two most common ways (based off this hypothetical).

#1 The Quick Short

The quick and dirty option resembles a sneaky right hook into the stomach. 👊

The fund has taken the lead component of stock and is likely your broker’s biggest client (and, therefore, much bigger than you).

Tuesday - Either through the broker or another party, as soon as the fund has its allocation, they borrow the same amount of stock.

Wednesday - They’re armed with 30m shares that they sell into the market, pushing the share price from $0.12 down to or below the $0.10 placement offer price.

Friday - They get their 30m shares and settle the short position.

The beautiful thing is, they haven't had to front any cash.

The short sell on Wednesday (say they averaged at $0.11) bought in $3.3m, which they used to settle on Friday. This leaves a cosy $300k minus a bit of interest.

That's lovely for them (a nice little sum for a few days' work).

Everyone else, though, not so much.

They will get their stock on Friday (or Monday, depending on their broker). The stock price will probably be sub $0.10, and everyone knows they got screwed.

Who do they blame? The easiest target that's in front of them; ABC Corporate Ltd.

At least the fund made a bit of cash, though…

#2 Outperforming Benchmarks

Funds make money differently compared to you and me.

They're like boats; no matter the size or direction of the wave, they bob up and down but always manage to stay afloat.

You and I make absolute returns. We invest in a stock at $0.10, and we need it to be more than that when we sell to make money.

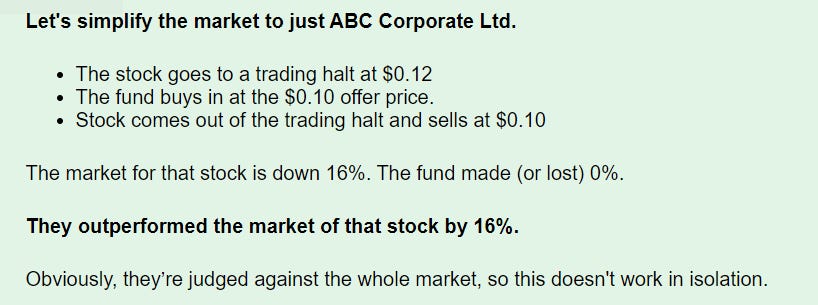

Funds tend to make money on relative returns against their benchmarks.

They invest in a stock at $0.10, and if the market drop by 10%, all they need to do is get out anywhere above $0.09 to outperform the market relatively.

There is ONE fund (any guesses?) that is everyone’s biggest client. They go into every deal. Not just every deal in the ASX 200, but everything but the end of the long tail.

In that way, they constantly outperform, even if they sell for a loss. It’s factored into their alpha from the start; the deal gives them that.

The stock drops 30%. They only dropped 14%. An absolute loss but a relative win.

The stock goes up 10%. They went up 26%. An absolute win but an even bigger relative win.

And we haven’t even mentioned the options…

Either way, they're making money.