Don't have any news? Here's how to continue to communicate with shareholders.

We all know the type of announcement.

- Market sensitive? ✔️

- TITLE IN ALL CAPS? ✔️

- Pump up small results? ✔️

With investors complaining on HotCopper about a “lack of newsflow” and an unexplained drop in share price, you start to feel newsflow pressure.

Surely something is better than nothing?

But we can't put the same thing out. We need a different view. A different angle.

So you put something together and push it out, managing to dodge the ASX review team.

Annnnnd...

Crickets...

Nothing really happens. Investors are satiated, for a time, but they're not really happy.

And why would they be? Bugger.

We can do better. You know we come with answers and not just problems - so here are 5 alternatives you can do when news flow is slow. 🐢

#1 Asynchronous Investor Webinars.

This is done in three easy steps, which give you investor engagement AND two ASX releases. Excellent!

- Push out an ASX release informing the market of the release of a webinar in a week, and invite questions to you.

- The day before release, record the webinar and take people through a deck or answer questions (the ones you want to answer). Because it's pre-recorded, you can take your time and put together a great piece of content.

- Release the link and announce it to the market.

#2 Follow The Smart Money

This may be easier if you have institutional investors, but get 1 or 2 of your top 20 (people who are not associated directly with the company) and interview them on why they're invested.

“Why I bought ABC by Fidelity Portfolio Manager” would get picked up quickly, giving investors a look into others in the same position.

#3 Think PR, Not IR.

If you don't have anything for the market, shift your IR attention to PR work. Get in articles, pitch ideas, and perhaps pay for exposure.

Balance those quiet periods where you don't have ‘new’ news for your current audience, by finding a new audience for your current news. 🔍

The aim of this should be maximising email signups or on-market support. Making it public (interviews, press) adds the possibility of it being picked up by social media etc.

#4 Get Physical

Take your shareholder list (and perhaps those who have sold recently) and do a roadshow. 🚗

Pick a capital city or two, based on your shareholders, and invite them for a meal or a drink.

They may not be your best friends, but they are your shareholders. A shake of a hand, a shared experience. This can help turn a critic into an advocate. An advocate into a prophet.

#5 Ask Questions Instead Of Giving Answers

This one won't solve your immediate issue but may help over time. Create two lists - investors being loud, and investors you want.

The loud investors are those emailing, posting or ranting about your lack of news.

The investors you want are targets; institutions, strategics, and brokers.

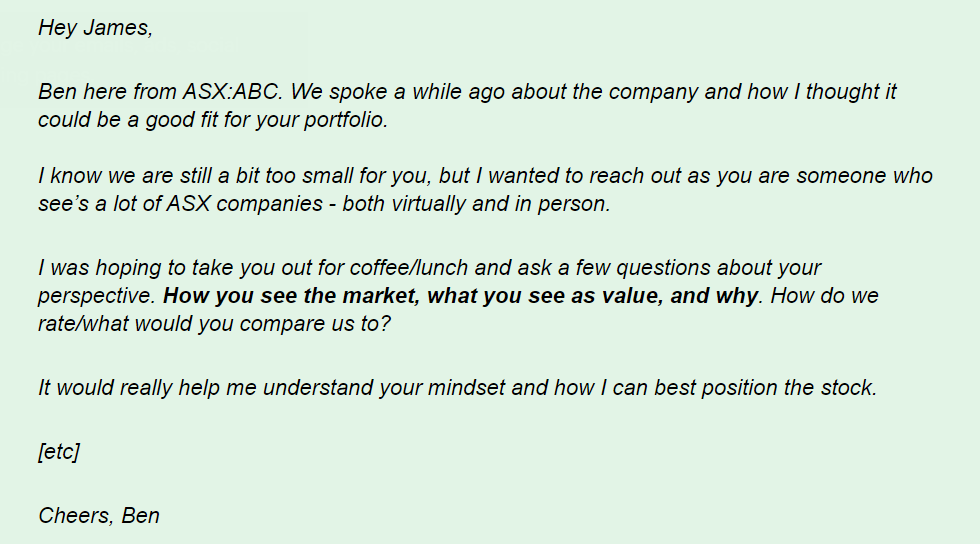

Put 5 names in each list. Then reach out to them with something like…

It's definitely putting yourself out there and sounds vulnerable, but sometimes asking for advice is a great way to start a relationship with someone.

Especially if it's genuine.

Plus, it might get those active "WHERE IS THE NEWSFLOW???" posters off your back for a bit if you engage them directly.